What Is Considered a High Debt-To-Equity D E Ratio?

Each industry has different debt to equity ratio benchmarks, as some industries tend to use more debt financing than others. A debt ratio of .5 means that there are half as many liabilities than there is equity. In other words, the assets of the company are funded 2-to-1 by investors to creditors. This means that investors own 66.6 cents of every dollar of company assets while creditors only own 33.3 cents on the dollar.

What Does a Negative D/E Ratio Signal?

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

What is your risk tolerance?

The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style.

The Limitations of Debt-to-Equity Ratios

And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow. Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio. At accounts payable bookkeeper jobs employment the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.10% per year.

It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering. A high D/E ratio suggests that the company is sourcing more of its business operations by borrowing money, which may subject the company to potential risks if debt levels are too high. A D/E ratio of about 1.0 to 2.0 is considered good, depending on other factors like the industry the company is in. But a D/E ratio above 2.0 — i.e., more than $2 of debt for every dollar of equity — could be a red flag. Again, context is everything and the D/E ratio is only one indicator of a company’s health. Debt-to-equity ratio is just one piece of the puzzle when it comes to evaluating stocks.

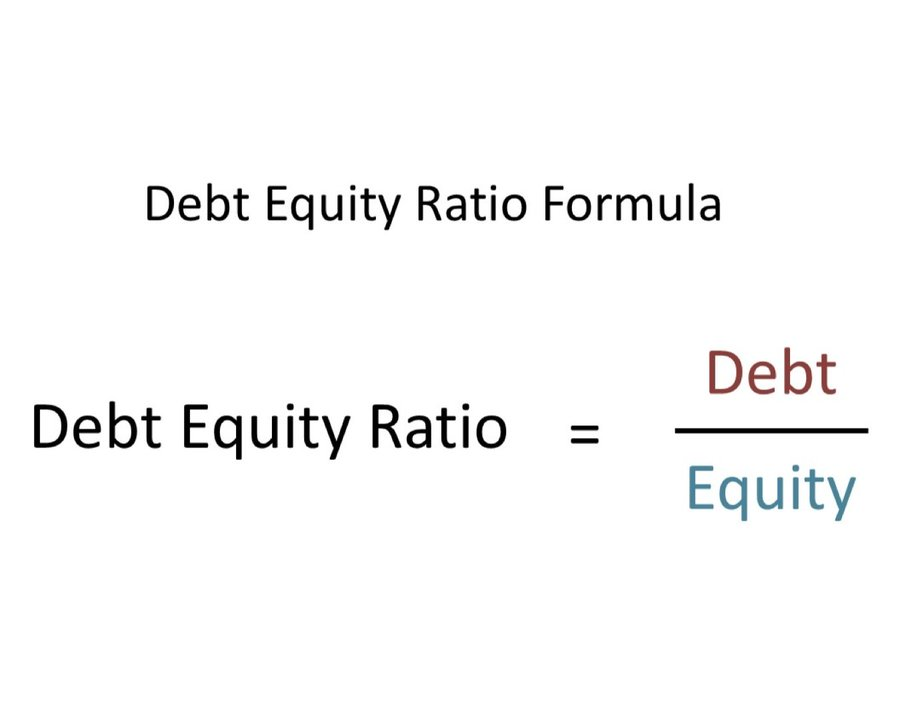

Debt to equity ratio is the most commonly used ratio for measuring financial leverage. Other ratios used for measuring financial leverage include interest coverage ratio, debt to assets ratio, debt to EBITDA ratio, and debt to capital ratio. A company’s debt to equity ratio can also be used to gauge the financial risk of the company. If a company is using debt to finance its growth, this can potentially provide higher return on investment for shareholders, since the company is generating profits from other people’s money.

- What is considered a high ratio can depend on a variety of factors, including the company’s industry.

- It’s packed with all of the company’s key stats and salient decision making information.

- The current ratio reveals how a company can maximize its current assets on the balance sheet to satisfy its current debts and other financial obligations.

- Total debt represents the aggregate of a company’s short-term debt, long-term debt, and other fixed payment obligations, such as capital leases, incurred during normal business operations.

- My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

Here, “Total Debt” includes both short-term and long-term liabilities, while “Total Shareholders’ Equity” refers to the ownership interest in the company. A higher ratio may deter conservative investors, while those with a higher risk tolerance might see it as an opportunity for greater returns. Let’s examine a hypothetical company’s balance sheet to illustrate this calculation. The nature of the baking business is to take customer deposits, which are liabilities, on the company’s balance sheet. Some analysts like to use a modified D/E ratio to calculate the figure using only long-term debt. As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade.

He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career. As established, a high D/E ratio points to a company that is more dependent on debt than its own capital, while a low D/E ratio indicates greater use of internal resources and minimal borrowing. This result indicates that XYZ Corp has $3.00 of debt for every dollar of equity. Overall, the D/E ratio provides insights highly useful to investors, but it’s important to look at the full picture when considering investment opportunities.

“Therefore, a lower debt-to-equity ratio implies that equity holders have a greater chance of benefiting from growth in retained earnings over time and a lower risk of default.” When used to calculate a company’s financial leverage, the debt usually includes only the Long Term Debt (LTD). The composition of equity and debt and its influence on the value of the firm is much debated and also described in the Modigliani–Miller theorem. While the D/E ratio is primarily used for businesses, the concept can also be applied to personal finance to assess your own financial leverage, especially when considering loans like a mortgage or car loan.

For this to happen, however, the cost of debt should be significantly less than the increase in earnings brought about by leverage. Before that, however, let’s take a moment to understand what exactly debt to equity ratio means. However, it is crucial to compare the D/E ratio with peers in the same industry and consider the company’s specific circumstances for a more insightful analysis. In fact, a firm that uses its leverage to capitalize on a high-return project will likely outperform one that uses very little debt but sits in an unfavorable position in its industry, he says. For example, utilities tend to be a highly indebted industry whereas energy was the lowest in the first quarter of 2024.

These can include industry averages, the S&P 500 average, or the D/E ratio of a competitor. It’s also helpful to analyze the trends of the company’s cash flow from year to year. You can calculate the D/E ratio of any publicly traded company by using just two numbers, which are located on the business’s 10-K filing. However, it’s important to look at the larger picture to understand what this number means for the business. It’s clear that Restoration Hardware relies on debt to fund its operations to a much greater extent than Ethan Allen, though this is not necessarily a bad thing.